Understanding Connecticut Property Revaluations and Appeals

What Every Homeowner and Investor Should Know for the 2025-2026 Tax Cycle

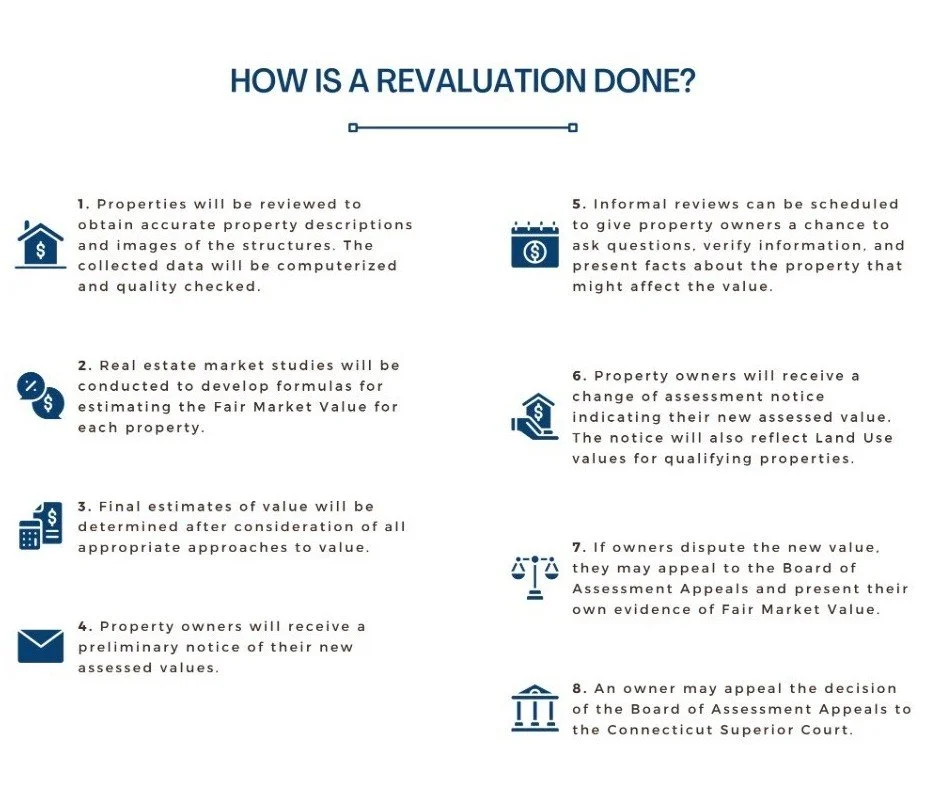

Property tax revaluations are a routine part of owning real estate in Connecticut, yet they are often misunderstood. When a new assessment notice arrives, many homeowners immediately worry that higher taxes are inevitable. Revaluations are a structured and predictable process designed to keep tax burdens fair across a town, not to single out individual properties.

Below you will find a practical explanation of how Connecticut’s revaluation system works, how assessments translate into tax bills, and when it may make sense to consider a formal appeal. My focus is clarity, context, and smart decision-making, especially for homeowners in towns like Fairfield, Westport, and Bridgeport undergoing the 2025 revaluation cycle.

The Purpose of Revaluation: Fairness, Not Revenue

Connecticut law requires municipalities to revalue real property every five years. The reason is simple: real estate markets change. Without periodic revaluation, similar homes could pay dramatically different taxes based solely on when they last sold.

Revaluations are designed to:

Reflect current market conditions

Value similar properties consistently

Distribute the tax burden equitably

A revaluation does not raise taxes by itself. It recalibrates values so the town can fairly allocate its tax levy among all property owners.

How Properties Are Valued

During a revaluation year, towns determine each property’s market value as of October 1. Market value represents what a willing buyer would reasonably pay a willing seller under normal market conditions.

Most municipalities hire professional revaluation firms that rely on:

Recent comparable sales

Neighborhood and market trends

Property characteristics such as size, age, and condition

Computer-assisted mass appraisal models

While this system is efficient, it is not perfect. Unique homes, waterfront properties, custom construction, or homes that haven’t sold in many years are more prone to valuation errors. That is why review and appeal options exist.

From Market Value to Assessed Value

Connecticut applies a uniform assessment ratio statewide: 70 percent of market value.

Example:

Market Value: $900,000

Assessed Value: $630,000

The assessed value, not the market value, is what appears on the town’s records and is used to calculate property taxes.

The Grand List, Explained Simply

Once assessments are complete, the town compiles its Grand List. The Grand List represents the total assessed value of all taxable property in the municipality, including:

Real estate

Motor vehicles

Business personal property

A higher Grand List does not automatically mean higher taxes for everyone. In strong real estate markets, Grand Lists often increase substantially. What matters most is how an individual property’s assessment changes relative to the rest of the town.

How Mill Rates Turn Assessments into Taxes

The mill rate converts assessed value into an actual tax bill. One mill equals one dollar of tax for every $1,000 of assessed value.

The formula is straightforward:

Assessed Value × Mill Rate = Annual Property Tax

Mill rates are set after the town approves its annual budget, typically in the spring following a revaluation. When the Grand List rises significantly, mill rates often decrease to keep overall tax revenue stable.

As a result:

A higher assessment does not automatically mean higher taxes

Taxes tend to increase when a property’s value rises faster than the town average

Why the 2025 Revaluation Cycle Is Different

The current revaluation cycle reflects one of the strongest real estate markets in Connecticut history. Since the last cycle in 2020, many areas have experienced price increases exceeding 60 percent.

This creates two key factors:

Many homeowners will see meaningful assessment increases

Tax burdens will shift between neighborhoods and property types

Some homeowners may see little change in taxes, while others, particularly those whose properties appreciated faster than average, may see increases.

Key Dates Homeowners Should Know

Understanding the timeline is critical:

October 1, 2025: Official valuation date

December 8th, 2025: Notices mailed to homeowners

December 23rd, 2025: Vision Government Solutions will meet by phone or in person with property owners to review new assessments.

January–February 2026: Appeal window with the Board of Assessment Appeals

February 20th, 2026: DEADLINE FOR FORMAL APPEALS

Spring 2026: Town budgets and mill rates finalized

July 2026: New tax bills take effect

Importantly, homeowners must decide whether to appeal before final mill rates are known.

How to Review Your Assessment

When your assessment notice arrives, take a systematic approach:

Confirm the market value and assessed value

Review the property record card for factual accuracy

Compare your assessment with recent nearby sales

Consider whether your increase aligns with neighborhood trends

Minor discrepancies are common. Meaningful errors or disproportionate increases deserve closer review.

When an Appeal May Make Sense

Appealing an assessment is not about avoiding taxes, it is about accuracy and fairness. An appeal may be worth considering if:

The market value appears overstated

The property is unique or difficult to compare

Property details are incorrect

The assessment increased significantly more than similar homes

Because assessments remain in place for five years, even modest reductions can result in meaningful long-term savings.

The Two-Step Appeal Process

Board of Assessment Appeals (BAA)

The first level of appeal is local. Homeowners may present evidence themselves or work with professional representation. Many cases are resolved at this stage.

Superior Court

If the BAA does not adjust the value, homeowners may appeal to Connecticut Superior Court. This step requires a certified appraisal and is typically reserved for higher-value disputes. Most cases settle before trial.

Evaluating Cost Versus Benefit

Appeals should be viewed as a five-year financial decision. Legal and appraisal costs must be weighed against projected tax savings.

In general, appeals tend to make sense when properties are over-assessed by a meaningful margin, particularly in towns with higher mill rates.

Common Mistakes to Avoid

Expecting assessments to reflect pre-pandemic prices

Ignoring recent purchase or listing prices

Missing appeal deadlines

Assuming partial reductions are insignificant

A realistic, data-driven approach is far more effective than an emotional one.

Final Perspective

Revaluations are not designed to punish homeowners. They are a recalibration intended to keep property taxation fair as markets evolve. For many homeowners, the right move is simply understanding the process and moving forward.

For others, especially those with unique properties or disproportionate increases, a thoughtful review and possible appeal can result in substantial long-term savings.

Knowledge, timing, and perspective are the most valuable tools a homeowner has during a revaluation cycle.